Supply Chain Financing

Supply chain financing is a financing method initiated by an Anchor Buyer to help its Suppliers to finance their invoices, which otherwise may be challenging under normal lending criteria.

This financing is made available to all suppliers for approved invoices and can be drawn when required.

Benefits to Buyers

Improved Buyer-Supplier relationships

Extended payment terms - improved cashflow

No costs to administer program

Benefits to Suppliers

Availability of financing with no additional collaterals

Improved Cash Conversion Cycle - from delivery to cash

Flexibility - Draw funds only when required

Explanation

In a normal Supply Chain set up, a buyer purchases goods from a supplier with a pre-agreed credit term, typically 30 or 60 days.

In the event the supplier requires cash flow before he receives this payment, the supplier can go to a bank to get working capital. However, smaller suppliers would typically struggle to get such approved loans due to the bank’s tight lending criteria as well as due to their less desirable credit standing.

This is where SCF can come in to help suppliers attain financing lines from a financier on the favourable credit standings of their buyers.

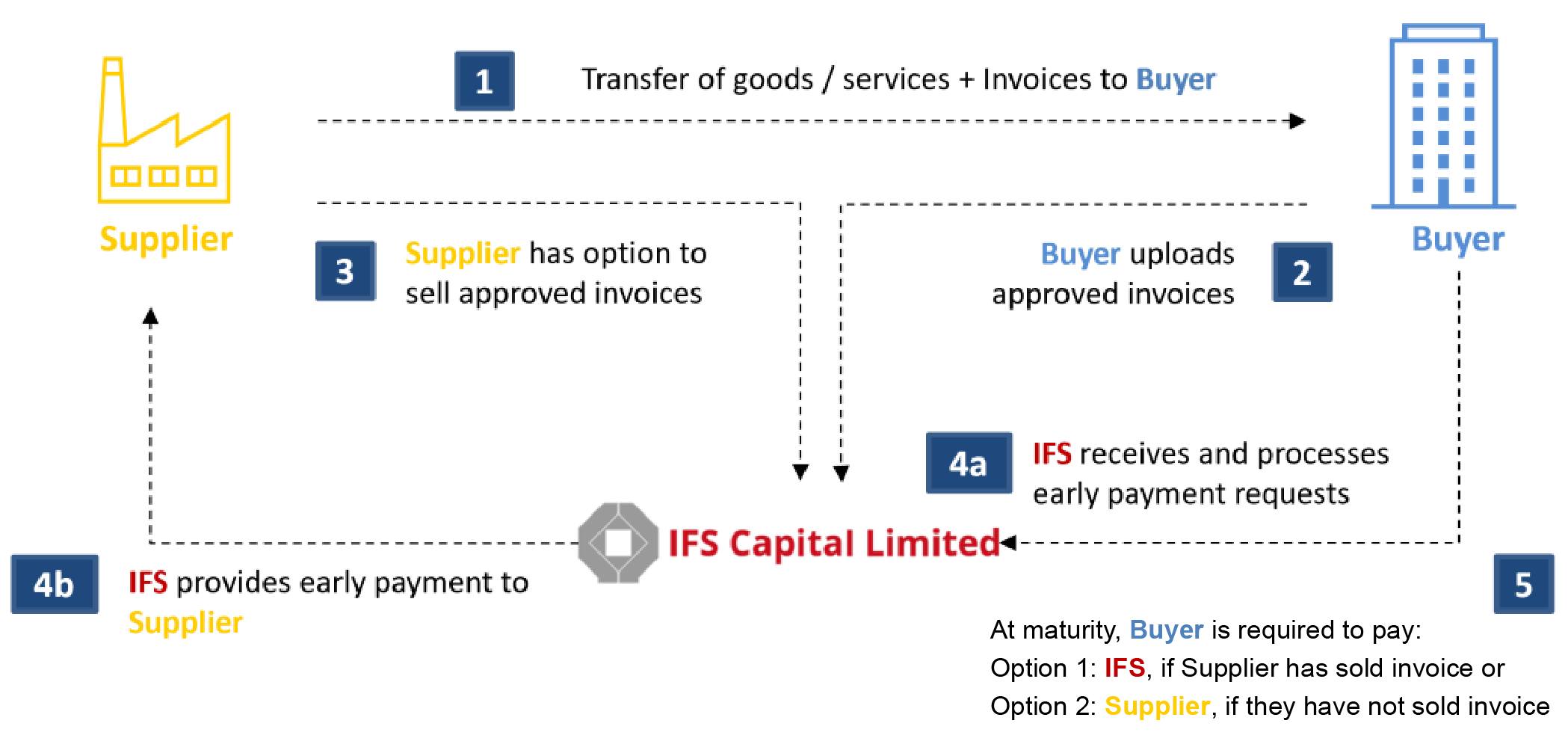

How it works

About PrimeRevenue

PrimeRevenue's supply chain finance (reverse factoring) solutions help organizations in 80+ countries optimize their working capital to efficiently fund strategic initiatives, gain a competitive advantage and strengthen relationships throughout the supply chain.

As the leading provider of working capital financial technology solutions, PrimeRevenue's diverse multi-funder platform processes more than $250 billion USD in payment transactions per year.

The company is headquartered in Atlanta, with offices in London, Prague, Hong Kong and Melbourne.